5starsstocks.com Cannabis: Your Guide to Smart Cannabis Stock Investing

5starsstocks.com cannabis investing can transform your portfolio. Many investors miss out because they don’t know where to start. Cannabis stocks offer massive growth potential, but picking winners is tricky.

Here’s the good news: You don’t need to be an expert. With the right guidance, anyone can invest smartly in cannabis stocks. 5starsstocks.com provides research-backed recommendations that cut through the noise.

This guide reveals everything you need to know. You’ll discover how to identify promising cannabis stocks. You’ll learn to avoid common pitfalls. Plus, you’ll get actionable strategies to maximize returns. Let’s dive into the world of cannabis investing together.

Understanding 5starsstocks.com Cannabis Stock Recommendations

5starsstocks.com focuses on data-driven cannabis stock analysis. The platform doesn’t guess. It uses market trends, financial metrics, and industry insights.

Cannabis stocks behave differently than traditional investments. They’re volatile. Regulations change overnight. One positive news story can spike prices 30% in days.

That’s where expert analysis helps. 5starsstocks.com tracks dozens of cannabis companies. It identifies which ones have solid fundamentals. You get clear buy, hold, or sell signals.

How the Platform Analyzes Cannabis Stocks

The analysis process considers multiple factors. Revenue growth matters most. A company must show consistent sales increases quarter over quarter.

Profitability comes next. Many cannabis companies burn cash. The best ones approach breakeven or show positive earnings. This signals maturity and sustainability.

Market position also counts. Does the company dominate its niche? Strong brands and distribution networks indicate long-term viability. Competition is fierce in cannabis. Only the strongest survive.

Why Cannabis Stocks Need Specialized Research

Cannabis operates in a unique regulatory environment. Federal laws contradict state laws. Banking restrictions limit operations. These factors don’t affect normal stocks.

Traditional stock analysis misses these nuances. You need cannabis-specific expertise. 5starsstocks.com provides that specialized knowledge. It monitors policy changes that impact valuations instantly.

Top Cannabis Stock Categories on 5starsstocks.com

Different cannabis companies serve different purposes. Understanding categories helps you diversify smartly. Each sector offers unique risk-reward profiles.

Cultivation Companies grow the actual plants. They’re heavily regulated. Equipment costs run high. But successful growers generate strong margins. Think of them as agricultural businesses with premium products.

Retail Dispensaries sell directly to consumers. They benefit from increasing legalization. Customer loyalty drives repeat business. Location matters tremendously for dispensaries.

Biotech Cannabis Firms develop medical applications. They research cannabinoids for specific conditions. These companies offer huge upside potential. But they’re also the riskiest category.

Multi-State Operators (MSOs)

MSOs operate across multiple legal markets. They’re the giants of cannabis. Vertical integration gives them competitive advantages.

These companies control supply chains end-to-end. They grow, process, and sell their products. Efficiency improves. Profit margins expand.

Curaleaf, Trulieve, and Green Thumb Industries lead this space. They’re available on 5starsstocks.com cannabis watchlists. Their scale provides stability during market downturns.

Ancillary Services and Technology

Not all cannabis stocks touch the plant. Ancillary companies provide essential services. They face fewer legal complications.

Hydrofarm manufactures growing equipment. GrowGeneration sells supplies to cultivators. These businesses profit regardless of which growers succeed.

Technology platforms also thrive. Point-of-sale systems, compliance software, and delivery apps serve the industry. They’re often overlooked gems.

How to Use 5starsstocks.com for Cannabis Investing

Start by creating a free account. Browse the cannabis sector specifically. The platform categorizes stocks by risk level and growth potential.

Beginner investors should focus on established MSOs. These offer stability with growth. They’re less likely to disappear overnight.

Aggressive traders might prefer small-cap cultivation startups. Higher risk brings higher potential returns. But never invest more than you can lose.

Reading Stock Ratings and Reports

Each cannabis stock gets a star rating. Five stars means strong buy. One star signals avoid. The rating considers dozens of metrics automatically.

Detailed reports explain the reasoning. You’ll see revenue projections, competitive analysis, and risk assessments. Everything’s in plain English, not financial jargon.

Pay attention to price targets. These show where analysts expect the stock to trade. Compare current prices to targets. Big gaps indicate opportunity.

Setting Up Custom Alerts

Don’t miss important updates. Set alerts for your cannabis stocks. You’ll get notifications when ratings change or news breaks.

This feature saves hours of research time. The platform monitors constantly. You stay informed without obsessive checking.

Key Metrics for Evaluating Cannabis Stocks

Numbers tell the real story. Pretty websites and flashy marketing mean nothing. Focus on fundamentals that predict success.

Revenue growth rate should exceed 20% annually. Anything less suggests problems. The cannabis market expands rapidly. Companies should grow with it.

Gross margins indicate pricing power. Strong cannabis companies maintain 40%+ gross margins. Lower margins mean fierce competition or poor operations.

Cash burn rate reveals sustainability. How many quarters can the company survive? Calculate by dividing cash reserves by quarterly losses. You want at least 4-6 quarters of runway.

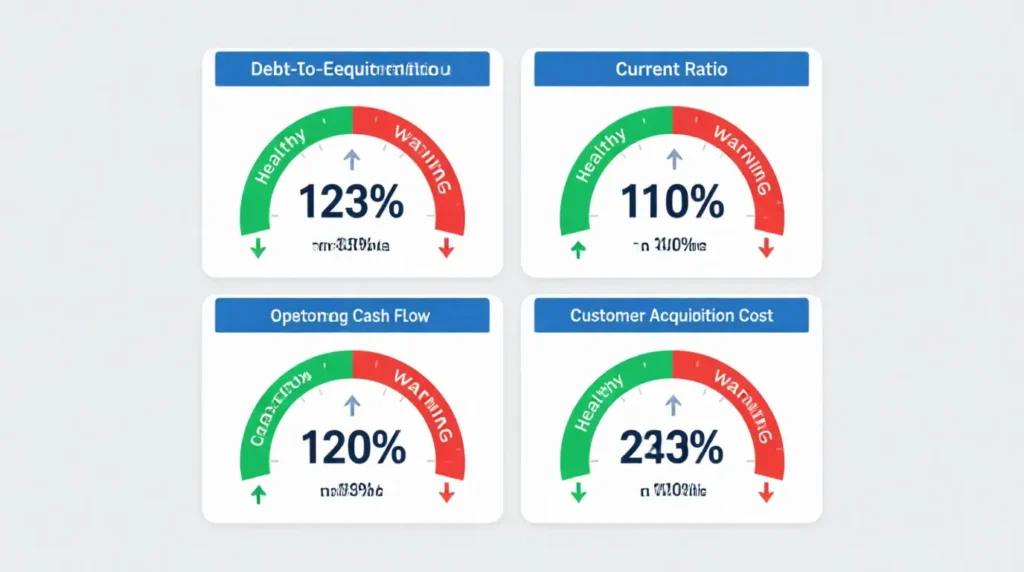

Financial Health Indicators

| Metric | Healthy Range | Warning Sign |

|---|---|---|

| Debt-to-Equity Ratio | Below 0.5 | Above 1.0 |

| Current Ratio | 1.5 or higher | Below 1.0 |

| Operating Cash Flow | Positive or improving | Consistently negative |

| Customer Acquisition Cost | Declining over time | Rising quarter over quarter |

These metrics appear in every 5starsstocks.com cannabis report. Learn to read them quickly. They separate winners from losers.

Market Position and Competitive Advantages

Financial metrics only tell part of the story. Market position determines long-term success. Does the company have something special?

Brand recognition matters enormously in cannabis. Consumers develop loyalties. Companies like Cookies and Stiiizy command premium prices because of their brands.

Intellectual property provides protection. Patents on cultivation techniques or product formulations create barriers to entry. Competitors can’t easily replicate success.

Timing Your Cannabis Stock Investments

Timing isn’t everything, but it matters. Cannabis stocks show predictable patterns. Understanding these improves returns significantly.

Earnings seasons create volatility. Stocks often drop before earnings, even with good news expected. This presents buying opportunities for patient investors.

Legislative events move entire sectors. Federal rescheduling discussions spike prices. State legalization votes do the same. 5starsstocks.com cannabis alerts track these catalysts.

Avoid FOMO (fear of missing out). Stocks that surge 50% in a week often crash 30% the next. Let the dust settle before buying.

Dollar-Cost Averaging Strategy

Buy the same dollar amount monthly. This strategy removes emotion from investing. You automatically buy more shares when prices drop.

For cannabis stocks, this approach makes tremendous sense. Volatility works in your favor. You accumulate shares at varying prices. Over time, your average cost decreases.

Set up automatic purchases if possible. Consistency beats trying to time perfect entry points. Most investors fail at market timing anyway.

Recognizing Entry and Exit Signals

5starsstocks.com provides clear signals, but understand the logic. Buy signals often trigger when:

- Stock drops 20%+ on no fundamental news

- Company reports earnings beat with revenue growth

- New market expansion gets announced

- Ratings upgrade from analysts

Sell signals appear when:

- Revenue growth slows for two consecutive quarters

- Management changes unexpectedly

- Regulatory setbacks impact operations

- Stock rises 100%+ (consider taking profits)

Risk Management for Cannabis Investments

Cannabis stocks carry above-average risk. Accept this reality upfront. Never invest emergency funds or money needed soon.

Position sizing protects your portfolio. No single cannabis stock should exceed 5% of total holdings. Diversify across multiple companies and categories.

Even within cannabis, spread investments. Own cultivators, retailers, and ancillary players. If one segment struggles, others may thrive.

Diversification Within the Cannabis Sector

| Company Type | Risk Level | Recommended Allocation |

|---|---|---|

| Large MSOs | Medium | 40-50% |

| Mid-Cap Growers | Medium-High | 25-30% |

| Small-Cap Startups | High | 10-15% |

| Ancillary Services | Low-Medium | 15-20% |

This allocation balances growth and stability. Adjust based on your risk tolerance. Conservative investors lean toward MSOs and ancillary companies.

Understanding Regulatory Risks

Federal prohibition creates unique challenges. Banking remains difficult. Interstate commerce stays illegal. These restrictions limit growth potential.

But change is coming. Momentum builds for rescheduling or legalization. When federal barriers fall, cannabis stocks will soar. Positioning now captures that upside.

Stay informed about legislation. The SAFE Banking Act could transform the industry overnight. The MORE Act would enable full legalization. 5starsstocks.com cannabis alerts track these developments closely.

Comparing 5starsstocks.com to Other Cannabis Research Platforms

Many services offer cannabis stock advice. What makes 5starsstocks.com different? Several factors set it apart.

Objectivity comes first. The platform doesn’t accept payment from cannabis companies for coverage. Recommendations stay unbiased and data-driven.

Accessibility matters too. Reports use clear language. You don’t need a finance degree to understand the analysis. Complex concepts get explained simply.

Track record speaks loudest. Historical recommendations show proven accuracy. Past performance doesn’t guarantee future results, but it builds confidence.

Feature Comparison Table

| Feature | 5starsstocks.com | Competitor A | Competitor B |

|---|---|---|---|

| Cannabis-Specific Analysis | ✓ | Limited | ✓ |

| Real-Time Alerts | ✓ | ✓ | ✗ |

| Educational Resources | ✓ | ✗ | Limited |

| Price | Affordable | Expensive | Free (lower quality) |

| Track Record Transparency | ✓ | ✗ | ✗ |

Free services typically lack depth. Expensive alternatives often don’t justify the cost. 5starsstocks.com hits the sweet spot for most investors.

For deeper insights on maximizing stock research platforms, check out comprehensive stock analysis strategies.

Building a Long-Term Cannabis Portfolio Strategy

Quick trades rarely build wealth. Long-term investing beats short-term speculation. Cannabis requires patience despite the volatility.

Three-to-five-year horizons make sense for cannabis. The industry is still maturing. Companies need time to establish dominance and profitability.

Reinvest dividends if available. Most cannabis stocks don’t pay dividends yet. But some Canadian companies do. Compound growth accelerates returns.

Rebalancing Your Portfolio Quarterly

Markets shift. Winners become overweight in your portfolio. Losers shrink to tiny positions. Rebalancing maintains your intended allocation.

Sell portions of big winners. Use proceeds to buy underperformers that still have strong fundamentals. This “buy low, sell high” happens automatically.

Don’t rebalance too frequently. Quarterly works well for cannabis stocks. More frequent changes generate unnecessary transaction costs and taxes.

Tax Considerations for Cannabis Investors

Capital gains taxes apply to profitable sales. Hold stocks over one year for long-term rates. Short-term gains get taxed as ordinary income.

Losses offset gains. If a cannabis stock fails, the loss reduces your tax bill. Keep records of all transactions for tax time.

Tax-advantaged accounts (IRAs, 401ks) shelter gains from taxes. Consider holding volatile cannabis stocks there. You won’t owe taxes on trading activity.

Frequently Asked Questions

Is 5starsstocks.com cannabis investing suitable for beginners?

Yes, absolutely. The platform provides educational resources alongside stock recommendations. Beginners can start with small positions in established companies. Use the detailed reports to learn as you invest. Risk management tools help protect against major losses.

How often does 5starsstocks.com update cannabis stock ratings?

Ratings update continuously as new data emerges. Major changes trigger immediate alerts to subscribers. Quarterly earnings always prompt fresh analysis. You’ll never invest based on outdated information. The platform monitors 24/7 automatically.

Can I trust 5starsstocks.com cannabis stock predictions?

No prediction is guaranteed. However, the platform’s methodology is transparent and data-driven. Historical accuracy rates are published openly. Focus on the analysis quality, not perfect predictions. Use recommendations as one input in your decision-making process.

What’s the minimum investment needed for 5starsstocks.com cannabis stocks?

Most cannabis stocks trade under $20 per share. You can start with just $100-$200. Dollar-cost averaging works with any budget. The platform doesn’t require minimum investment amounts. Start small and increase as you gain confidence.

How does 5starsstocks.com handle cannabis regulatory changes?

The platform employs specialists who monitor federal and state legislation. Policy changes get analyzed for impact immediately. Affected stock ratings adjust accordingly. Subscribers receive alerts about significant regulatory developments. This keeps you ahead of market reactions.

Are international cannabis stocks covered on 5starsstocks.com?

Yes, coverage includes Canadian and European cannabis companies. International markets offer different opportunities and risks. Currency fluctuations add another variable. The platform’s global perspective helps identify the best opportunities worldwide.

Conclusion

5starsstocks.com cannabis investing doesn’t have to feel overwhelming. You now understand how to use the platform effectively. You know which metrics matter most. You’ve learned smart risk management strategies.

Start with established companies while learning the sector. Use alerts to stay informed without constant monitoring. Diversify across multiple cannabis categories. Most importantly, maintain a long-term perspective.

Cannabis legalization continues expanding globally. Early investors position themselves for substantial gains. 5starsstocks.com provides the research and tools you need to succeed.

Take action today. Review the top-rated cannabis stocks on the platform. Start small with one or two positions. Learn from each investment. Your future self will thank you for starting now.